The question of whether a dog tax is fair has sparked lively debates across communities. Proponents argue it could address public concerns, while opponents warn of unintended consequences. Here, we explore 10 distinct perspectives that shed light on this topic.

Economist’s Perspective

From a financial angle, a dog tax could generate revenue for municipalities burdened with pet-related expenses. Public parks, sanitation, and animal control often require funding, and a tax could aid in covering these costs. However, critics argue it may disproportionately affect low-income dog owners.

Economists must balance cost-benefit analyses to determine if such a tax truly benefits the community. Would the financial gains outweigh the potential reduction in dog adoptions? Such questions remain pivotal. A nuanced understanding of economic impact is crucial to this debate.

Pet Owner’s Concerns

For many, dogs are family, not just pets. Opponents of a dog tax worry about the financial strain, especially in today’s economy. Emotional bonds are priceless, yet the added financial burden could deter potential pet adopters.

The relationship between human and canine is complex and filled with love. Policies affecting this bond should be considered with empathy. Advocates for pet owners emphasize understanding these emotional and financial challenges. They argue against measures that might reduce the joy pets bring into homes.

Animal Shelter Insights

Shelters play a vital role in pet care and population control. A dog tax might provide necessary funds to support this mission. More money could mean better facilities, resources, and opportunities to rescue more animals.

However, shelter workers express concerns about increased surrenders if taxes discourage pet ownership. Balancing financial needs with ethical considerations remains a challenge. The goal is to foster an environment where animals find loving homes, not face abandonment due to economic decisions.

Public Health Angle

Public health experts often link pet ownership with positive health outcomes, like reduced stress and increased physical activity. A dog tax could fund community programs aimed at promoting these benefits.

However, there’s a risk of discouraging ownership, which may lead to lower public health benefits overall. The delicate balance between community health support and accessibility needs careful attention. Policymakers must weigh these factors when considering a tax on dogs.

Environmental Considerations

Dogs, though beloved, can impact the environment. Waste management and land use for dog parks are pressing issues. A tax might encourage eco-friendly practices and fund green initiatives.

Environmentalists advocate for sustainable pet ownership. However, they caution against measures that might limit access to pets. Harmonizing ecological responsibility with the joy of pet companionship is key. Broad policies should aim to support both environmental health and community well-being.

Legal Expert’s View

Legal frameworks surrounding pet taxes are complex. A dog tax would need to navigate intricate legal landscapes. Lawyers focus on ensuring such taxes comply with broader legal standards.

Concerns about privacy, fairness, and discrimination may arise. Legal experts stress the importance of drafting clear, justifiable policies. The challenge lies in creating laws that protect both public interests and individual rights. Legal considerations are as vital as economic and ethical ones.

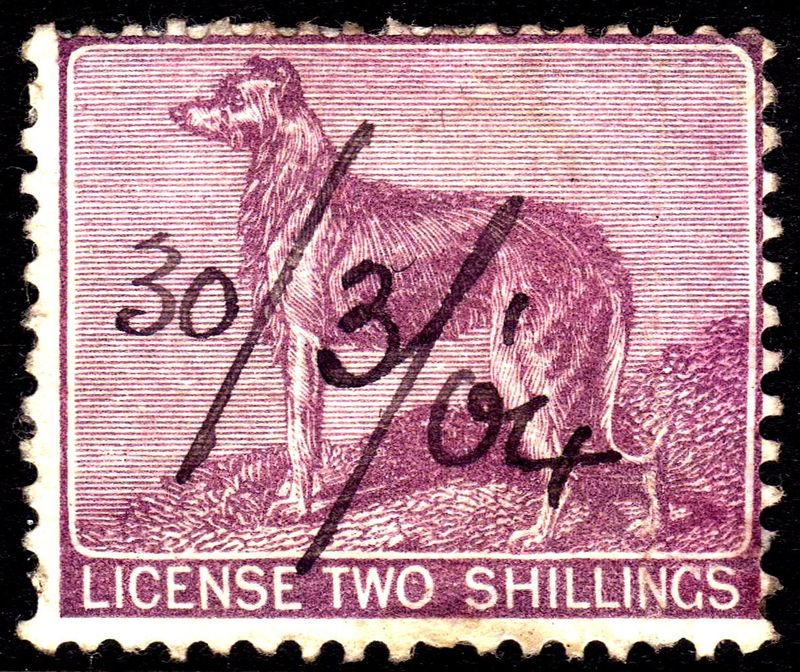

Historical Context

Dog taxes aren’t new; they’ve appeared throughout history. In medieval times, taxes on dogs were used to control populations and fund local infrastructure.

Historical analysis provides a backdrop for modern debates. Learning from past successes and failures can guide current policy decisions. Historians remind us that while the contexts have changed, the core issues often remain the same. An informed perspective considers both past and present.

Animal Rights Perspective

Animal rights advocates prioritize the welfare of animals in any taxation discussion. They argue that a dog tax could inadvertently harm pets by reducing adoption rates.

The ethical treatment of animals should guide policy decisions. Balancing financial needs with humane considerations is key. Providing exemptions or sliding scales could help mitigate negative impacts. Animal welfare must be central to tax discussions.

Community Leaders’ Opinions

Community leaders often find themselves at the forefront of the debate. They gauge public sentiment, balancing diverse opinions and needs.

A dog tax can be divisive, with strong opinions on both sides. Leaders must navigate these waters carefully, ensuring all voices are heard. Community engagement and transparent discussions can help find middle ground. Success lies in policies that reflect the collective will.

International Comparisons

Examining global dog tax policies reveals a spectrum of approaches. Some countries see success in using taxes to fund animal welfare, while others struggle with enforcement.

International comparisons offer valuable insights into potential outcomes. Analysts emphasize learning from both successes and failures abroad. Tailoring policies to local contexts while drawing on global experience is essential. The international landscape of dog taxation is both varied and instructive.